All Categories

Featured

Table of Contents

Owners can alter recipients at any point throughout the contract duration. Proprietors can choose contingent recipients in case a would-be successor passes away prior to the annuitant.

If a married couple possesses an annuity collectively and one partner passes away, the surviving partner would remain to receive settlements according to the terms of the agreement. To put it simply, the annuity continues to pay out as long as one partner lives. These contracts, often called annuities, can additionally include a 3rd annuitant (commonly a child of the pair), who can be marked to get a minimal number of repayments if both companions in the initial agreement die early.

Is there tax on inherited Index-linked Annuities

Below's something to maintain in mind: If an annuity is funded by an employer, that organization has to make the joint and survivor plan automatic for couples that are wed when retired life takes place., which will certainly affect your month-to-month payment in different ways: In this instance, the month-to-month annuity settlement continues to be the exact same adhering to the death of one joint annuitant.

This sort of annuity might have been acquired if: The survivor intended to take on the economic duties of the deceased. A couple took care of those obligations with each other, and the making it through partner wants to avoid downsizing. The surviving annuitant gets only half (50%) of the regular monthly payout made to the joint annuitants while both lived.

How is an inherited Period Certain Annuities taxed

:max_bytes(150000):strip_icc()/do-beneficiaries-pay-taxes-life-insurance.asp-final-7e81561536514dbdb30500ba1918afb3.png)

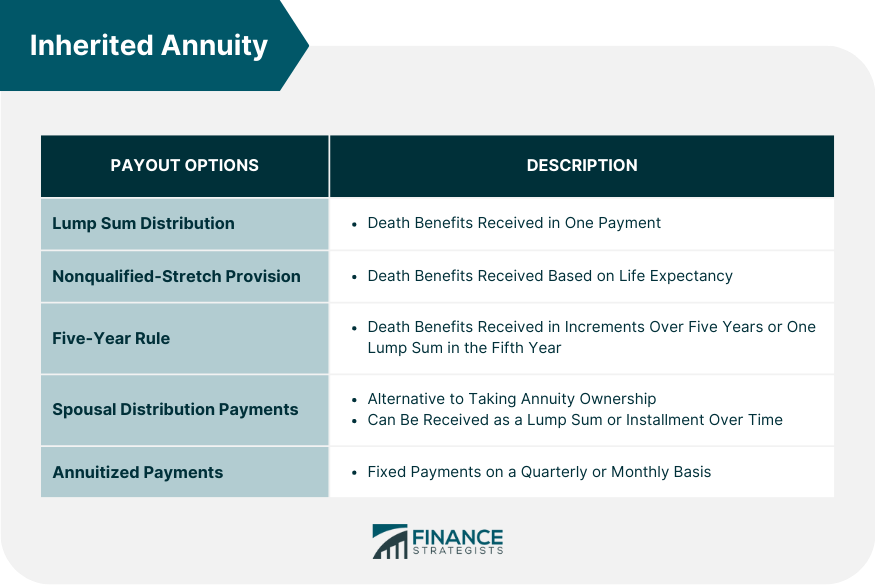

Numerous agreements enable a making it through partner noted as an annuitant's beneficiary to convert the annuity into their own name and take over the initial agreement. In this circumstance, known as, the making it through partner becomes the new annuitant and gathers the continuing to be repayments as arranged. Partners likewise may choose to take lump-sum payments or decline the inheritance for a contingent recipient, who is qualified to receive the annuity just if the main beneficiary is incapable or reluctant to approve it.

Paying out a round figure will certainly cause differing tax obligations, relying on the nature of the funds in the annuity (pretax or currently strained). However taxes won't be sustained if the spouse remains to receive the annuity or rolls the funds right into an individual retirement account. It might appear weird to designate a small as the recipient of an annuity, yet there can be excellent reasons for doing so.

In other instances, a fixed-period annuity might be used as a vehicle to money a kid or grandchild's university education and learning. Annuity fees. There's a distinction between a depend on and an annuity: Any type of money appointed to a trust must be paid out within five years and lacks the tax advantages of an annuity.

A nonspouse can not typically take over an annuity contract. One exception is "survivor annuities," which provide for that backup from the beginning of the contract.

Under the "five-year policy," beneficiaries may delay claiming money for approximately 5 years or spread out repayments out over that time, as long as all of the money is accumulated by the end of the 5th year. This allows them to expand the tax obligation concern over time and may maintain them out of greater tax brackets in any kind of single year.

When an annuitant passes away, a nonspousal beneficiary has one year to set up a stretch circulation. (nonqualified stretch provision) This layout establishes a stream of revenue for the remainder of the recipient's life. Due to the fact that this is set up over a longer duration, the tax obligation implications are commonly the smallest of all the alternatives.

Annuity Rates and beneficiary tax considerations

This is occasionally the instance with prompt annuities which can begin paying out quickly after a lump-sum financial investment without a term certain.: Estates, counts on, or charities that are recipients must take out the contract's complete worth within 5 years of the annuitant's fatality. Taxes are influenced by whether the annuity was moneyed with pre-tax or after-tax bucks.

This just suggests that the cash purchased the annuity the principal has currently been tired, so it's nonqualified for taxes, and you do not have to pay the internal revenue service once again. Just the rate of interest you make is taxable. On the various other hand, the principal in a annuity hasn't been strained yet.

So when you take out cash from a certified annuity, you'll need to pay tax obligations on both the passion and the principal - Tax-deferred annuities. Profits from an acquired annuity are treated as by the Irs. Gross income is earnings from all resources that are not especially tax-exempt. It's not the very same as, which is what the Internal revenue service makes use of to determine just how much you'll pay.

If you acquire an annuity, you'll have to pay revenue tax obligation on the distinction in between the primary paid into the annuity and the worth of the annuity when the owner passes away. For instance, if the proprietor bought an annuity for $100,000 and made $20,000 in interest, you (the recipient) would certainly pay tax obligations on that particular $20,000.

Lump-sum payments are tired simultaneously. This option has the most extreme tax effects, since your earnings for a solitary year will certainly be much higher, and you might wind up being pushed into a greater tax obligation brace for that year. Gradual repayments are taxed as income in the year they are received.

The length of time? The average time is regarding 24 months, although smaller sized estates can be taken care of quicker (often in as little as six months), and probate can be even much longer for more complicated cases. Having a valid will can accelerate the process, but it can still get slowed down if successors contest it or the court needs to rule on that must carry out the estate.

Are Annuity Withdrawal Options death benefits taxable

Because the individual is named in the contract itself, there's absolutely nothing to competition at a court hearing. It's crucial that a details person be called as beneficiary, instead than simply "the estate." If the estate is named, courts will examine the will to sort things out, leaving the will certainly open up to being objected to.

This might deserve thinking about if there are legit bother with the individual named as recipient passing away prior to the annuitant. Without a contingent beneficiary, the annuity would likely after that end up being based on probate once the annuitant dies. Speak with an economic advisor regarding the potential benefits of naming a contingent recipient.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Defining Fixed Annuity Vs Equity-linked Variable Annuity Features of Pros And Cons Of Fixed Annuity And Variable

Understanding Immediate Fixed Annuity Vs Variable Annuity A Comprehensive Guide to Variable Vs Fixed Annuities What Is What Is A Variable Annuity Vs A Fixed Annuity? Benefits of Fixed Index Annuity Vs

Highlighting Variable Annuities Vs Fixed Annuities A Closer Look at How Retirement Planning Works What Is Tax Benefits Of Fixed Vs Variable Annuities? Benefits of Choosing the Right Financial Plan Why

More

Latest Posts